Protecting your assets during a high-net-worth divorce starts with proactive, strategic planning: drafting airtight prenups or postnups, establishing trusts or LLCs to ring-fence wealth, and maintaining meticulous records so every dollar is accounted for.

At Northwest Family Law, we take a holistic approach to family law, helping our clients transform pain into hope and build a brighter future. Divorce is about working hand-in-hand with financial planners, healthcare providers, and other professionals to stabilize every aspect of your world.

Key Takeaways

- High-net-worth divorces average 12–18 months and can top $100k in professional fees, proactive structuring often cuts both metrics nearly in half.

- Separate before you negotiate. Trusts, LLCs, and airtight prenup/postnup agreements keep the most valuable assets outside the marital pot.

- Know your jurisdiction. Nine community-property states force a 50/50 split,the other 41 weigh “fairness,” giving strategic room to maneuver.

What Qualifies as a High-Net-Worth Divorce?

Most professionals flag a case as “high net worth” once the marital estate tops $1 million in liquid or easily valued assets. Some firms raise the bar to $5 million when complicated, illiquid holdings (private equity, multiple properties) are involved.

Why complexity drives cost:

- Diverse asset classes (real estate, stock options, crypto) each need separate valuation.

- Cross-border or multi-state holdings trigger extra tax and jurisdiction checks.

- Higher privacy stakes mean sealed filings and private judges, services that add fees.

Prenuptial vs Postnuptial Agreements

Prenups: Sign before “I do.”

- Must include full financial disclosure and separate counsel for each spouse.

- Courts throw out terms deemed “unconscionable” or that waive child support.

Postnups: Your second chance.

- Useful after sudden windfalls (IPO, inheritance).

- Survive best when they mirror the fairness standards of prenups and avoid punitive clauses.

Advanced Asset-Protection Tools: Trusts, LLCs & Offshore Strategies

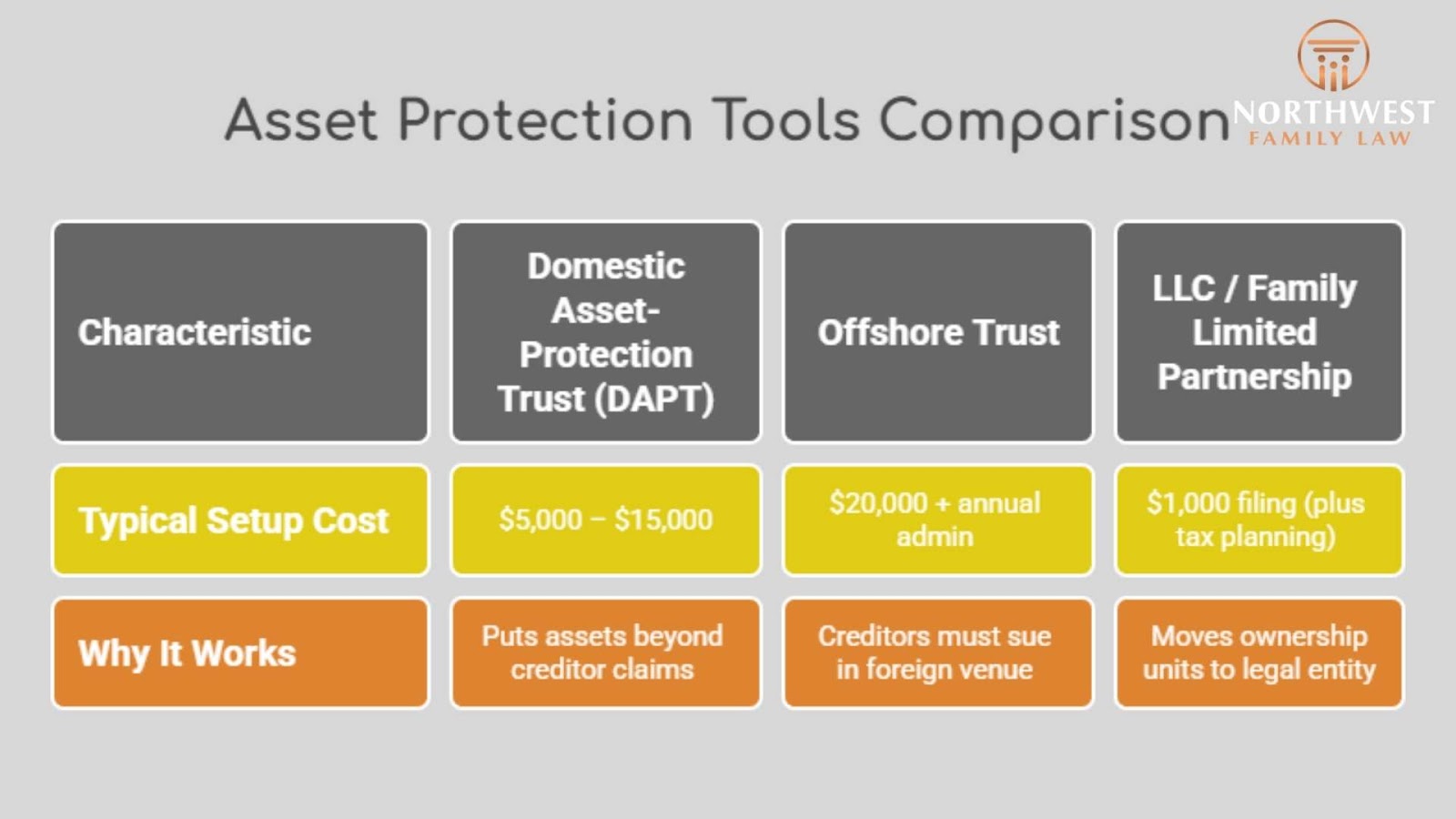

| Tool | Typical Setup Cost | Why It Works |

| Domestic Asset-Protection Trust (DAPT) | $5,000 – $15,000 | Puts assets beyond most future creditor (and spouse) claims after a statutory seasoning period. |

| Offshore Trust (e.g., Cook Islands) | $20,000 + annual admin | Creditors must sue in the foreign venue and post a large bond first. |

| LLC / Family Limited Partnership | <$1,000 filing (plus tax planning) | Moves ownership units, not the underlying assets, into a separate legal entity. |

Protecting Business & Professional Practices

- Value early. Courts favor a single, credible appraisal over dueling professionals.

- Use buy-sell clauses. Pre-set pricing formulas curb courtroom battles.

- Isolate cash flow. Keep retained earnings in a separate corporate account once divorce is impending.

- Avoid common mistakes. Don’t rely on outdated financial statements, underestimate tax impacts, or neglect thorough disclosure. Errors here can cost you 10–30% of your company’s appraised value.

Dealing with Executive Compensation: RSUs, Options & Bonuses

- Trace vesting schedules to split only the marital portion.

- Apply a QDRO for qualified plans, negotiate tax-adjusted buyouts for non-qualified options.

- Model the tax hit, the non-employee spouse often prefers cash equalization at net value.

State-by-State Asset-Division Rules

Nine jurisdictions follow strict community-property law: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. Everyone else uses “equitable distribution,” where judges balance factors like earning power and need.

Hidden Assets & Forensic Accounting: Red Flags

- Sudden crypto transfers to new cold-wallet addresses.

- Overpaying the IRS (refund arrives after divorce).

- Loans to closely held companies controlled by a spouse.

Book Your 20-Minute High-Asset Protection Audit

No two families-or financial portfolios-are the same, so your asset-protection plan shouldn’t be either. At Northwest Family Law, we blend deep legal knowledge with a network of financial planners, healthcare providers, and wellness professionals to help you build a brighter, more confident future.

Our white-glove service means you’ll receive proactive updates, high-touch communication, and a personalized strategy tailored to your unique needs. Investing in our holistic approach is about protecting your long-term well-being and peace of mind.

Schedule your no-cost consultation today and take the first step toward rebuilding your life with confidence.